In January we continued reducing our exposure to P2P having it representing now around 3% of our portfolio (it was 5% in November – 2019). We reduced exposure mostly in Robo.cash and Mintos since Wisefund and Monethera currently frooze buyback due to widespread panic in the P2P market. We have now not more than 400€ exposure to any LO originator and since the money was sitting around in robo.cash i figured why not removing it from the platform.

Additionally, our ETF portfolio also suffered a decrease (altough as the time of this report it recooped the value and plus some more) due to the panic with CoronaVirus in the emerging markets. This affected several ETFs – and the global market – due to fears of factories stopping production in China since workers could not go to work due to contagion possibilities.

When it comes to risk we are very conservative at the moment and cash plenty, as you can see we haven’t invested any of our proceedings from the Apartement sale. We are currently validating with an accountant exactly how much do we need to invest in order to minimize tax payment.

Taxes after selling an apartment

In Portugal when you have a plus from a sale of your main property you need to pay tax on 50% of that plus. Now, that tax will be included in your normal yearly tax. Nonetheless, there are some exclusions to this rule which are the ones everyone uses to avoid paying that tax. Good explanation – here (only in portuguese).

In this case we have bough the apartment for 172.5k and sold it for 305k which amounts to 132.5k. Now we can deduct several things here like home improvements costs, mediation costs, costs that you had when you bought the place, etc. There is also an inflation adjustment based on the year that you acquired the property. After deducting all of this, the value stands at 101k. In this case 50% of this value would be liable to tax payment, meaning 50.5k.

Now, the rule to be excluded from this tax is that up to 36 months after the sale (3 years) you need to reinvest into another property and that property needs to be your main household.

The value that you need to invest from your own money is calculated by Price of sale – morgage on the property . In this case, we had 2 morgages on the apartment. We are validating with the accountant if they both count or if only the one we used for aquiring the apartment. In this case we talk about Morgage 1: 139 853,65 €, Morgage 2: 29 156,23 € .

Current options to validate:

a) According to our accountant only the first should be used, meaning we would need to invest ~165k (305k – 140k). Damn…too much, we dont have that much and would need to take a personal loan or to pay a proporcional of the tax…:(

b) According to the public services tax branch we went, what matters is the value of the loans we terminated once we sold the apartment, in this case, the full morgages. This would mean 136k (305k – 140k – 29k). Which is much preferable and we will have the cash in 3 years for sure.

I now will do a written questioning to the Portuguese IRS in order to have this sorted out and a proof when submitting our taxes. Better to play it safe.

There are still some questions like would this need to be the value we invest in total (new property price + tax) or does it only count for property value? This makes a big difference since when buying you need to pay municipal tax and gov tax which can be around 20k for a 200k property.

This will have impact on what we plan to do with this sum, ranging from improvements on the farm to me taking an MBA and how much do we want to invest in a new property (we have a few ideas already). Remember it needs to be a “single” apartment.

Coming to our monthly networth…

Summary:

Our Networth value for January is 395 822.50€ (-845.45)

January adjustments:

- We have started to account for vacations in our monthly budget. For this month to avoid removing money that we consider “saved” we have parked a bigger sum in our checking account ~500€ more.

- We also had vacations, 10 days in Ireland and we circled the whole island. Pretty cool. Definitly recommend! We spent 2k on those vacations. So after all, not a bad month!

Assets:

Investment accounts

- ETFs Portfolio: 23 314.53 € (-243.52)

- Retirement Accounts (aka PPR): 14 622.63 € (+589.12)

- Certificates Deposit + Emergency Fund: 130 305.32 € (+2853.35)

- P2P Portfolio: 11 037.56 € (-4 388.58)

- Total Investment accounts: 179 280.04 € (- 1 180.63)

Real Estate (Based on Market Values)

- Primary Residency: 300 000 €

- Farms: 70 000 €

- Total Real Estate: 370 000€ (Removed Rental property)

Cars

- Mr.Firecracker Car: 20 000 €

- Mrs.Firecracker Car: 18 000 €

- Scooter: 1 500 €

- Total Cars: 39 500€ (=)

Total Assets: 588 780.04 € (-1 180.63)

Liabilities:

- Primary Residency: 192 957.54 € (-335.18)

Total Liabilities: 192 957.54 € (-335.18)

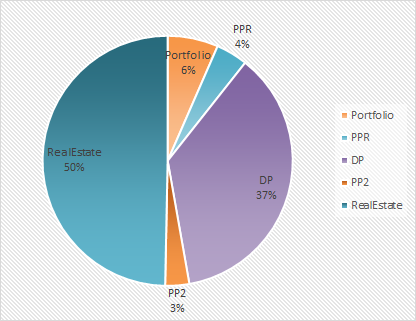

Our Networth drilldown looks like this:

You can follow our Networth status always here

Pingback: Networth Update - 03/2020 (March) | Firecrackers