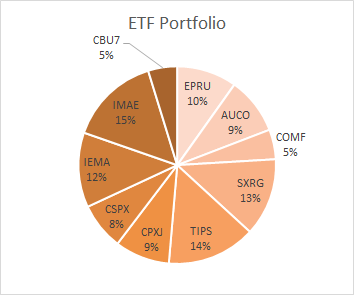

Our target ETF allocation is the following:

| Description | % Allocation | Ticker |

| Long bond | 5.00% | CBU7 |

| Short bond | 15.00% | TIPS |

| Commodity | 5.00% | COMF |

| Gold | 10.00% | AUCO |

| SP500 | 7.50% | CSPX |

| Small-Cap | 15.00% | IMAE |

| Europe | 10.00% | SXRG |

| REIT | 10.00% | EPRU |

| Pacific | 10.00% | CPXJ |

| Emerging | 12.50% | IEMA |

We currently have a total of 30 315.94€ – in our ETF Portfolio. (updated 02-01-2021)

Progress is the following:

Knowing that we had the following values:

01/01/2020 – 23 549,05

12/03/2020 – we invested 5 000

31/12/2020 – 30 315,94

Our XIRR for 2020 is 6,41%.

Our total XIRR since moving the portfolio 09/2019 is 8,65% (base value 22 501,78 €) and the total return (total value – all investments done) is 2 925,11 € which means 10,65%.

Dont forget to check our latest update.

We also use the broker Degiro which has the lowest rates on the market from Portugal.