As some of you might have noticed i’ve skipped the March update. I’ve not felt motivated to post last month since i think i was stuck in this loop, networth – real estate – construction – construction is not under control – shit. And then my attention would wonder into something i could do to speed things up. Since that was not possible..well..you see where this is going.

Lucklily now the contrators that we hired to do the garden have finished – well it still needs some working but most of the work is done. And… we have now a contract signed with the “big contractor” (lets call it that) for the value of ~147k + VAT.

This is a big number and it took several weeks of back and forth to also have the executation plan and the construction quantities defined.

Another reason maybe related with my motivation has been that our first contractor told us he wasnt too interested in the project since he would never be able to match the values we had and thus walked away..this was a setback but we managed to find another one via referrals.

The first payment is also done and will be reflected in next months networth update. For now, the trend is still down with -5k in April and -3k in March. Those are all related with the expenses for the garden.

April

On the P2P front, not much new besided getting a few cents back from Aforti. Hopefully Monego would pay soon.

Construction on the façade of our apartment is finished and the building end up quite nice. All of this is the result of the organization of Mrs.Firecracker. The next batch of works including the door repairs have not started yet.

Reno Updates

General updates:

1- Construction: Update above. Another info is that the reno should only be finished by end of February 2022.

2- Tax gains “Mais-valias”: Submitted the taxes for this year. I’m expecting to pay ~4k on that.

Savings Rate

Our savings rate has not been constant, in March we saved ~5% (with some extra 500€ health expenses) and on April we had another extra expense with our car of >2k. This adding up to some extra health expenses on January, February was the only month we had ~20% savings rate and saved 900€.

If we disregard the extra expenses we have even spent less that we budgeted.

April Summary:

1) Auto: Our car broke down and needed a new piece. They dont sell the piece individually and we had to buy a big chunk of parts..this was a very big expense but we need the car…

2) Projects: Received the 2.5k! Happy with this.

Now, coming to our monthly networth…

Summary:

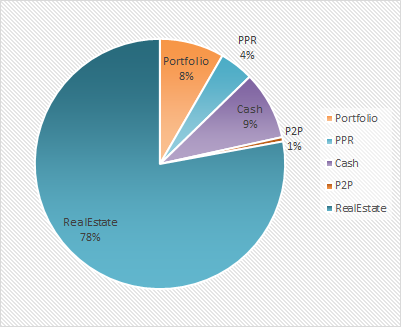

Our Networth value for April is 441 162.18€ (– 5 040.30)

Assets:

Investment accounts

- ETFs Portfolio: 33 446.03 € (+391.97)

- Retirement Accounts (aka PPR): 17 653.38 € (+418.98)

- Certificates Deposit + Emergency Fund: 35 485.59 € (– 6 665.56)

- P2P Portfolio: 2 238.76 € ( +0,01 )

- Total Investment accounts: 88 823.76 € ( -5 854.60)

Real Estate (Based on Market Values)

- Primary Residency: 300 000 €

- Farms: 70 000 €

- Rental House: 414.500

- Total Real Estate: 784 500€

Cars

- Mr.Firecracker Car: 20 000 €

- Mrs.Firecracker Car: 18 000 €

- Scooter: 1 500 €

- Total Cars: 39 500€ (=)

Total Assets: 912 823.76 € (-5 854.60)

Liabilities:

- Primary Residency: 187 763.49 € (-370.46)

- Rental House: 283 898.09 ( -443.84)

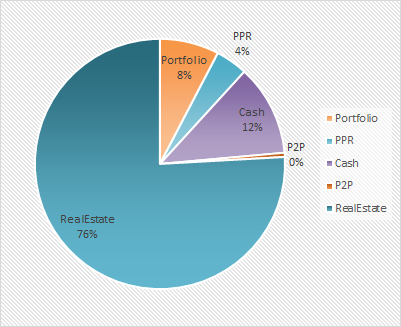

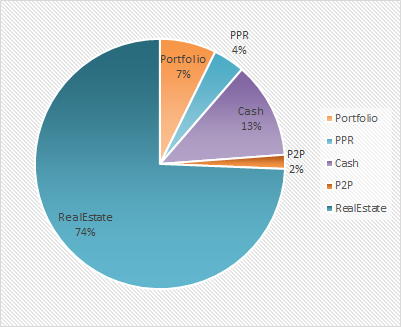

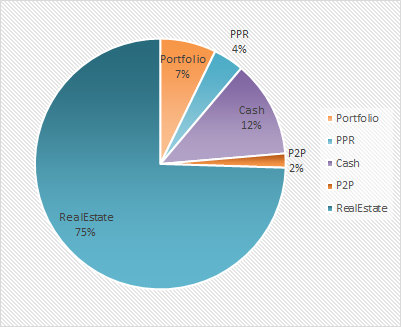

Our Networth drilldown looks like this:

You can follow our Networth status always here