This week i will be talking about another important step to define in order to reach FI in our Goals – Savings Rate!

So, last time i’ve written about defining our anual / monthly expenses. This is something we will be sharing more with you. It takes consistency and its something we already have to do. So why not share it with you? Missed the post? Check it here.

Step 2 – Defining a Safe Withdrawal Rate

Defining a safe withdrawal rate will in the end determine the amount of money you need to have with a ponderation of different scenarios like inflation, return on your investments., etc.

Currently several studies point to a SWR of 4% in case you will need to withdraw money for the next 30 years. See the trinity study here. There are also very nice explanations for other FIRE enthusiasts like Mad Fientist which gives you a more detailed view on how you should define your own SWR – check here – you can even test it and see how this will determine your speed to FI.

In order to calculate our time to FI we need to have:

Networth – What is the value of our Assets – Liabilities. This is where we are.

Monthly Expenses – How much do we spend per month. (ie – 1.600€). This is how much we need.

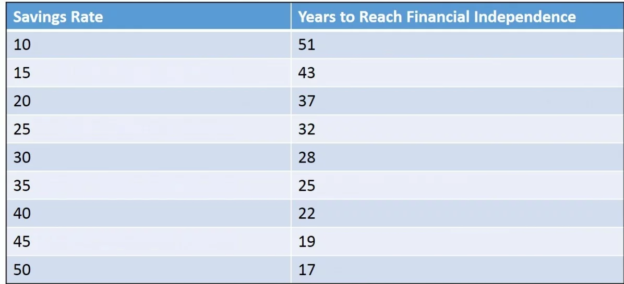

Savings Rate – How much are we saving per month (Income – Expenses). – Lets assume 1.200€, thats the value we will be getting in the next few months. This is how fast we are getting there.

Growth rate – How much (in %) do we expect our portfolio / investments will grow. Here i will assume 7% – if its great better! This also how fast we are getting there.

The 4% rule could be easily translated into multiplying your currently yearly expenses by 25 – check here on the Fire Movement wiki. Meaning the bigger our savings (& savings rate) are the faster we can get closer to this number.

Using the logic above, if we assume the 1 600€ monthly that we predicted. This would turn to 19 200€ yearly, which x25 will be 480 000€.

This is the first goal to achieve! And this is why you will see it on the banner on the right side of the blog!

You can also make a few dry-runs and use the FIRECalc to try for yourself.

In our case, here it is:

- Spending: 19 200€

- Portfolio value: 480 000€

- Years: 30 – Why 30? well i’m currently 31. Assuming we hit FI when i’m 35 it means i would need to live off my accounts until i’m 65 when my state pension will kick in.

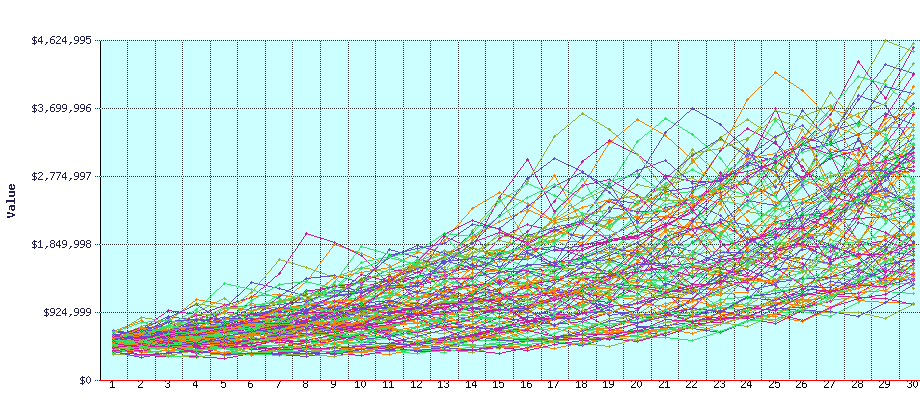

FIRECalc looked at the 119 possible 30 year periods in the available data, starting with a portfolio of $480,000 and spending your specified amounts each year thereafter.

Here is how your portfolio would have fared in each of the 119 cycles. The lowest and highest portfolio balance at the end of your retirement was $480,000 to $4,570,781, with an average at the end of $2,465,149. (Note: this is looking at all the possible periods; values are in terms of the dollars as of the beginning of the retirement period for each cycle.)

For our purposes, failure means the portfolio was depleted before the end of the 30 years. FIRECalc found that 0 cycles failed, for a success rate of 100.0%.

How to interpret would be to verify when any of the lines crosses the zero X axis. And in this case, it was 0 !

Now, assuming we cannot lower our monthly expenses to 1 600€, we also have the other scenario which is closer to our actual spending (we have an empty rental currently which means ~500€ pending in our necks) of 2 000€, this means:

First Milestone – 480 000€ for 1 600€;

Second Milestone – 600 000€ for 2 000€;

I will be tracking our progress towards the first milestone for now!

Since I’m all about teaching people how to fish, here are some of the resources i searched for this article:

- https://earlyretirementnow.com/2016/12/07/the-ultimate-guide-to-safe-withdrawal-rates-part-1-intro/

- https://www.investopedia.com/terms/s/safe-withdrawal-rate-swr-method.asp

- https://www.mrmoneymustache.com/2012/05/29/how-much-do-i-need-for-retirement/

- https://www.campfirefinance.com/4-percent-rule/

- https://www.iwillteachyoutoberich.com/blog/financial-independence/

- https://www.themoneycommando.com/safe-withdrawal-rate-early-retirement/

- https://financial-independence.eu/podcast/052-is-the-4-rule-still-valid-for-europeans-fire-the-boss/

- https://radicalfire.com/safe-withdrawal-rate-early-retirement/

Pingback: P2P Portfolio - Baseline! | Firecrackers

Pingback: Retire in Portugal | Firecrackers