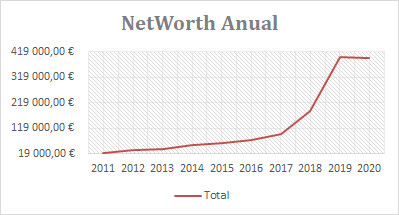

On my last posts i’ve started to analyse our 2020 goals and how did they went. I’ve started with the savings rate goal of 30% – we did 31% – followed by a networth increase of 10% – we did 15% – and today i’m going to focus on my entrepreneurship journey.

Back in February 2020 i did a post mentioning our 2020 goals and they could sum up to the following:

Financial

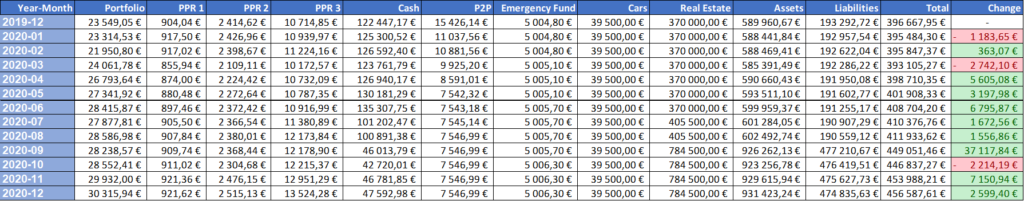

- Savings rate at 30% – done (31%)

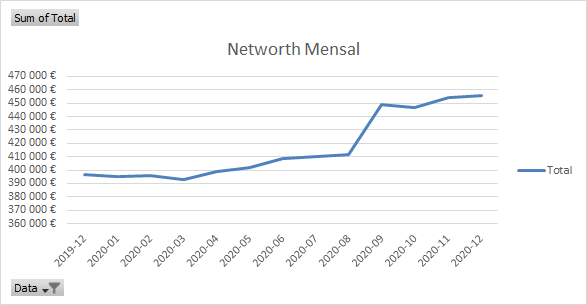

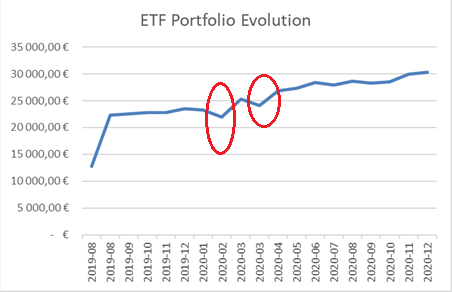

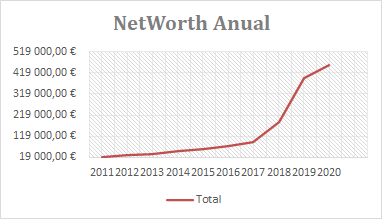

- Increase networth in 10% – done (15%)

- Starting a company and having revenue of at least 10k – 34% (3400 / 10.000) – not done

- Find a new property to invest (Optional) – done

Non-Financial

- Remodel the farm houses – we just had a small budget for some minor renovations in order for the main house to be usable. – not done

- Maintenance primary house – not done

My entrepreneurship journey:

In the beginning of 2020 i had a goal of starting my own company and having a revenue of at least 10k. I’ve started with 2 business ventures. One was to do IT consulting that could afterwords even become my full-time job and the other was to use the company my partner already had to sell an additional training product.

Trough the year i’ve tried many different things which resulted in the following:

- New IT Training venture – Failed

- IT Consulting – on going

- eHealth SW for doctors – Failed

- Selling of software licenses – Failed

- Bringing an energy company to PT and selling market analysis – Failed

- Developed a solution for ehealth with integrated micro-services – Failed

- IT Consulting partnering with a Marketing agency – Failed

- IT Patent predictive analystics software – Failed

- IoT Domotics project – on going

- IT Lecturing – done

There were different reasons for each failure and i’ve indeed learned a lot while doing this journey. This was all on top of my regular job and even if some of them required more attention, dedication or lasted longer they were all a journey.

As you can see one of them still keep going and this is the one with a bigger chance of resulting into a permanent consulting contract or another solution.

The other one IoT Domotics project is something i wont be spending more time and i expect to be implemented mid of 2021 therefore I havent received payment yet. Only once it starts.

Learnings

- Verify who you partner with – make sure that your partner is someone able to execute and has the same standards for quality, vision, etc that i have. Leadership matters and also organization. If the partner(s) is not commited then it would be easier for me to overcommit (since i’ve self-motived by nature) and then have the expection to get some return.

- Fail fast – do the minimum for a PoC and show the concept. if it doesnt fly i wont invest more time or effort into it.

- Manage expectations – Company cycles are very slow specially Portuguese companies. They tend to pass multiple layers of decision and even once all seems to be decided and to move forward, they can crash.

- How a small company operates from a tax perspective – major learnings into the in-and-outs of running a small company and how to set it up.

- How much to charge for my services, my partner value (what i bring to the table) and to negotiate that into a partnership, how to calculate a DCF and pitch to a VC.

Results

I’ve managed to hit 34% of my goal (3.400 / 10.000) that came from:

- IT Consulting – 2.000 €

- eHealth SW for doctors – 200 €

- IT Consulting partnering with a Marketing agency – 200 €

- IT Lecturing – 1.000 €

To the revenue if i exclude expenses that i had to execute the projects this would bring the value down to 2.500 €. Here i would need to pay taxes and include this income into my anual taxes.

For 2021 i would like to hit that mark excluding the rental income coming from the property.

For confidentialy reasons i’m not disclosing too much details on the projects but i do think they can be understood. If this is not the case, please shout out!