Welcome to the October Networth update! Bigger expenses! Investment renovation, 2nd wave of COVID and some housing extraordinary expenses.

Renovation

After the signing of the deal we have booked an architecture firm to work on the project. In a first phase we tough that we would be having them just for taking accurate measurements of the place but we decided to book them for the entire process which will cost us 11k total.

I dont want to transform the article into a renovation deep dive but as you can imagine this is quite an important topic for us (and it helps me to lay the steps by writting it…)

The first 3 months will be for planning components:

a) Close the final solution – 1 month

b) What materials to use and a detailed list of tecnical designs and items to use – 2 months

c) Contractor selection and price comparison – Should be quick (we have already a contrator who helped to calculate the costs of the project and ideally we would continue with him since the prices are in line).

Their first estimate put the construction costs to 155k + taxes which is inline to the estimate we got from the contractor 155k vs 158k.

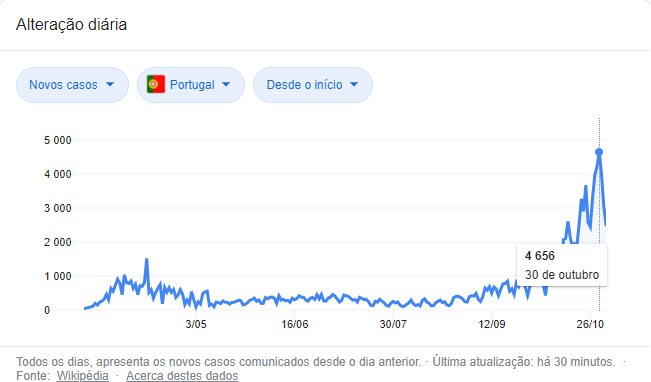

COVID19 – second wave (October)

Something that also started impacting our lives has been COVID’s second wave hitting Portugal and propelling our numbers to new maximums. This made restrictive measures to take place and we had to find innovative ways of being able to spend birthdays and events with our friends. For now we dont expect any impacts in our finances.

Unfortunetly this month we had several expenses which were even bigger than our income thus putting our savings rate to 0% this month. Expenses with the renovation will be increasing transforming cash into asset value (hopefully 🙂 ) and i’m not considering them in our operational monthly expenses since we have a separate account for this.

Our totals savings per month should now decrease with the new morgage from ~1200 € to about 500 € per month. Which means if we have an extra expense like a new huge bookshelf this will set us back for the month.

With this months 0% savings rate we have now a yearly savings rate of 35% which is still bigger than 30% we have put as our goal for 2020.

October Summary:

1) Extra expenses : 515 € bookshelf, 120 € for cleaning of the farm. Cleaning service costs for our apartment were also bigger since we have +1 week this month.

2) New house: Gardener + architecture signing contract = 2k.

3) Projects: No update here.

4) P2P world: Nothing new

Now, coming to our monthly networth…

Summary:

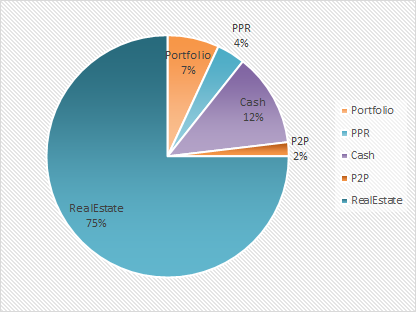

Our Networth value for September is 446 837.27€ (-2 214.19)

Assets:

Investment accounts

- ETFs Portfolio: 28 552.41 € (+313.84)

- Retirement Accounts (aka PPR): 15 431.07 € (–26.01)

- Certificates Deposit + Emergency Fund: 47 726.31 € (– 3 293.18)

- P2P Portfolio: 7 546.99 € ( – )

- Total Investment accounts: 99 256.78 € ( -3 005.35)

Real Estate (Based on Market Values)

- Primary Residency: 300 000 €

- Farms: 70 000 €

- Rental House: 414.500

- Total Real Estate: 784 500€

Cars

- Mr.Firecracker Car: 20 000 €

- Mrs.Firecracker Car: 18 000 €

- Scooter: 1 500 €

- Total Cars: 39 500€ (=)

Total Assets: 923 256.78 € (-3 005.35)

Liabilities:

- Primary Residency: 189 861.93 € (-348.74)

- Rental House: 286 557.58 ( -442.42)

Our Networth drilldown looks like this:

You can follow our Networth status always here

Pingback: Networth Update - 12/2020 (December) | Firecrackers