Welcome to the July Networth update! Networth increase of 1.6k, returning to normal!

On July we had awesome weather here in Lisbon and we started slowly to go for drinks in the afternoon with friends and relatives.

We also have some great news since after several months of search (and negotiation!!) we can finally announce that we will be buying a house! And not really any house i believe its fair to consider it a small building since we will 5 fractions to let! I will explain more down below.

Talking about good news i also gave my first Keynote speach in an executive program in a major known Portuguese university. Not only was it fun to share what i do, meet other executives from other companies (always good to increase network) and get paid for that !

July Summary:

1) Portfolio swings, coming back to values close to may (-1,89%) .

2) Saved 32% of our income (1347.37€ / 4181.13€). A little bit higher due to Mrs.Firecracker extra work this month.

3) Projects. If you recall my last post i explained 5 3 side projects i was working on besides my regular job. I will be giving an update on those from time to time since this could have a big impact into our financial progress.

Project A – Implementing a solution end-to-end for health (video, triage, IOT and analystics). Progress: I’ve quit from the partnership. Me and several other partners didnt think our product was good enought to apply for the RFP. Nonetheless, one of the partners holding the most needed technological piece decided to go alone. All i can wish is good luck!

Project B – with 1 partner doing a market analysis for implementing new player in the European market for the mobility + energy area. Progress: No news here. And i’m expectant to hear any news soon…

Project C – Consulting project for a major telecom player. Progress: We had a sit-down with the responsibles from the project and told them we need to act since the market is moving. They decided to ask us for a proposal to implement a showroom into their offices around september and we will comply. Here i expect to gain around 2.5k for a small project.

The domotics project was delivered to the customer and was submitted for financing here we wait for the results!

Project D – Since the beginning of this month i’ve decided to (similar to project C) do consultancy for other companies. I’ve partnered with a marketing agency that for now has brought different opportunities (and also, lets say…different working methods 🙂 ). Nevertheless, we managed to land a project with a furniture company and we should sign the deal end of August. This will be a 24 month contract that will net me ~22k. Monthly it will mean ~1.2k, just for one customer!

4) P2P world.

45.1) Wisefund – Nothing new. Some comms from Wisefund but no interest or principal returned yet.

4.2) Mintos – Nothing new…some people claim that interest is being paid but unfortunetly i have a lot still on hold in Monego and nothing got paid..

4.3) Monethera – still same. Nothing new.

5) New House: Finally! So this will be a 220 m2 house with 4 floors (Sub basement, basement, ground floor and attic). It also has a nice garden with around 100m2. All of this in the center of Lisbon and close to 3 major universities (2m driving). Sweet.

So how will this turn out?

This will be an aquisition & construction process. We are all set with the aquisition but the construction part will be a first for us. specially when it comes to credit for this process. We are king of struggling since the bank asks for many details that we will need to adapt only after the construction is very close to start..

Does it make sense financially?

Yes! We have 2 ways to measure this. Value & income.

For value we can calculate how much the house is worth and how much it will appreciate during the years to come. As they say you make money on the buy not on the sell. Despite the value metric since we are not going to fully finance the deal we need to account for funding expenses and what to actually do with the asset. This is where income comes to play. With income we calculate how much we could monetize the asset (rents, etc) minus costs (Morgage, repairs, taxes, etc).

Value

The house will cost us 374k (355k selling price + 19k buying expenses). We will take a credit of 242k for the aquisition and 110k for the construction. We need to do major remodeling otherwise we wouldn’t of course catch this awesome price!

In Total this will cost us 374k+110k (we are considering constrution to be fully financed) = 484k.

Despite the worth of the asset (location, facilities, degradation, etc) income can also influence the value, since the logic is the bigger money generator the most valuable the asset is.

In this case a building / house with 5 independent apartments (and another potentially with 20-35m2), namely 4×1 Bedroom apartment and 1×2 Bedroom apartment, newly refurbished, with river view, 100m2 garden in a decent Lisbon municipality neighborhood minimum price would be 700k.

Even considering that Portugal had the 4th largest GDP drop in the European Union – see here – i would have to say that for 700k you will not find a 100m2 garden for comparable buildings and this makes all the diference in Lisbon center.

Income

There were several simulations we did and already accounting for COVID19 rents impact. Currently we are also within a rental “moratory” which means since 1st April 2020 and until September (we will see if this wont be extended) several new rules come to enforcement:

- Financial support for tenants and guarantors of students who have no income from work and who, due to their loss of income, are unable to pay the rent. These tenants can access an interest-free loan granted by the IHRU to pay the rent due. The amount of this loan is equal to the difference between the monthly rent due and the amount resulting from applying a maximum effort rate of 35% to the household’s income. In no case shall the household’s remaining disposable income be lower than the social support index (IAS).

- Impossibility of cancelling rental contracts due to non-payment of rent during the state of emergency and provision for a special period for the payment of rent due for households with a significant drop in income. These tenants are required to pay the outstanding rent during the following twelve months in monthly instalments (not less than one twelfth of the amount due), paid together with the rent for each month. The landlord can only terminate the agreement if at the end of those twelve months the debt has not been paid in the prescribed manner. If during this period the tenant wishes to terminate the lease, he or she is obliged to make immediate payment of the unpaid rent.

- An indemnity for late payment of rent (in normal circumstances, equal to 20% of what is due) cannot be claimed in the event of late payment of rents in accordance with this scheme. Landlords on low incomes who have proven to have a significant loss of income due to non-payment of rents under this bill and whose tenants do not use a loan from IHRU, I.P. to pay the rent may apply to IHRU, I.P. for an interest-free loan to offset the amount of the monthly rent due but not paid.

See more details here.

What does it mean for us?

Well..its means rents will adjust to the crisis as always and we need to be carefull to not rent to someone who might take adantage of this moratory. If the moratory will indeed be extended and our construction ends before that. We plan it will take around 3 months. Summing up, this will mean a 1 bedroom ~50m2 (not refurbished) that would be rented by 600-700 € might likely drop to 550 €. A 2 Bedroom that would go for 900-1000 € might likely drop to 750-850 €.

As stated previously we have other factors in our favor like the garden and the fact that the whole thing is brand new, but we like to be conservative on this and by our calculations income would be as follows:

- Attic – 500 €

- Ground floor (2xbed) – 800 €

- Basement left – 600 € (larger area)

- Basement right – 600 € (larger area)

- Sub-basement right – 700 € (has a private part of the garden)

- Sub-basement left – 500 € (potential)

Total: 3 200 € (Gross) – not counting the potential one!

The costs we will have are:

- Mortgage – 865.80 € (with insurance already)

- Anual tax – 12.5 € (150 / 12)

- Rent income tax – 896 € (3.200 x 28%)

Total: 1 425.7 €

We still have some factors that might influence this like apartment occupancy (good rule of thumb is 80% calculation) and emergency nest for repairs. Even in this case we will have 5 years warranty on the construction.

Bottom line: ~ 17k net income per year. Taking in account we spent 135k of our savings its almost 12.5% return. Not bad 😀

What does it mean for our FI?

If you recall one of my first posts about our 2 milestones for FI we set our first objective in 1.600 € monthly and the second at 2.000 € monthly. With this deal we are very close to hitting our first milestone (even without moving to the countryside). AND! If we can use the potential other apartment our monthly income goes to 1786 € (3700 – 1036 – 12.5 – 865.8 ).

Now, coming to our monthly networth…

Summary:

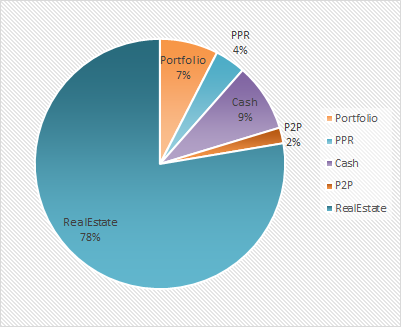

Our Networth value for April is 410 376.76€ (+1 672.56)

Assets:

Investment accounts

- ETFs Portfolio: 27 877.81 € (-538.06)

- Retirement Accounts (aka PPR): 14 652.93 € (+466.06)

- Certificates Deposit + Emergency Fund: 101 202.47 € (–34 105.28)

- P2P Portfolio: 7 545.14 € (+ 1.96)

- Total Investment accounts: 156 284.05 € ( –34 175.32)

Real Estate (Based on Market Values)

- Primary Residency: 300 000 €

- Farms: 70 000 €

- Rental investment: 35.500 (signal given for the preliminary contract)

- Total Real Estate: 405 500€

Cars

- Mr.Firecracker Car: 20 000 €

- Mrs.Firecracker Car: 18 000 €

- Scooter: 1 500 €

- Total Cars: 39 500€ (=)

Total Assets: 601 284.05 € (+1 324.68)

Liabilities:

- Primary Residency: 190 907.29 € (-347.88)

Our Networth drilldown looks like this:

You can follow our Networth status always here