In December we reduced exposure to Mintos P2P platform. If you have been following the news on the P2P area and if you are a fellow Mintos investor you might have noticed the following post on mintos blog. Basically the Loan originators from Mintos operating in Kosovo had their license revoked on the grounds of ignoring previous warnings due to imposing high interest rates and also compliance issues.

My first Mintos situation

The case gets a bit shady if we compare the financial size of Monego in Kosovo (~15M € in assets) and the way all has been handled. Shady goes not only on the direction of Kosovo authorities which Monego CEO points but also to Mintos situation with their LOs.

This is nothing new but when we have one of the founders of Mintos being Monego CEO the case gets quite tricky. We shouldn’t be naive to expect these fellows wont try to take advantage of complex tax schemes using shelter companies in Malta and other places to loan and borrow money to avoid taxation on gains. If they get too agressive on this (eg. borrowing with very high interests) they should pass, otherwise sometimes it get triggered.

This has caused an increase in Mintos secundary market circa + 100k loans. Personally, i’ve sold my positions to a maximum of 400€ per LO. With the current situation i’m currently locked with 732€ in Monego. In the meantime Mintos also announced Monego loans would be stated with Pending payments and would be assumed by Finitera group. Making sure when the loans were being payed in Kosovo the money would find his way towards “us” the investors.

Lets see what this will conclude…

Summary:

Our Networth value for December is 396 667.95€ (+1 258.93)

Hightights of December:

- Portfolio goes up! +5.27% up since August. I’m expecting some correction in the beginning of the year. Biggest increase in on the emerging markets.

- Got the final values of the rental apartment selling (+91k).

Assets:

Investment accounts

- ETFs Portfolio: 23 549.05 € (+626.48)

- Retirement Accounts (aka PPR): 14 033.51 € (+88.23)

- Certificates Deposit + Emergency Fund: 122 447.17 € (+2 525.60)

- P2P Portfolio: 15 426.14 € (-2 316.54)

- Total Investment accounts: 180 460.67 € (+ 924.07)

Real Estate (Based on Market Values)

- Primary Residency: 300 000 €

Rental property: 254 378.75 €- Farms: 70 000 €

- Total Real Estate: 370 000€ (Removed Rental property)

Cars

- Mr.Firecracker Car: 20 000 €

- Mrs.Firecracker Car: 18 000 €

- Scooter: 1 500 €

- Total Cars: 39 500€ (=)

Total Assets: 589 960.67 € (-924.07)

Liabilities:

- Primary Residency: 193 292.72 € (-334.86)

- Farm: 0 € – Fully paid. Was in the same credit aggrement has the apartment.

Total Liabilities: 193 292.72 € (-334.86)

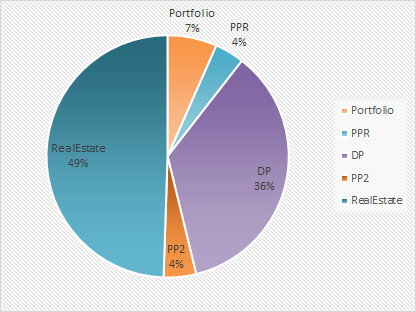

Our Networth drilldown looks like this:

You can follow our Networth status always here