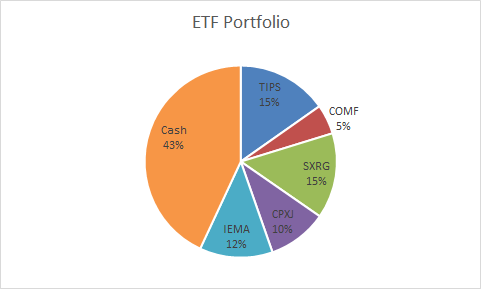

This was a month of restructuring our ETF Portfolio. Firstly i’ve shown you how our P2P Portfolio looks like, but this is not all. In fact our “Big” stategy relies on our ETF Portfolio baseline. Currently with some funds still on the way and starting to build up our position using the broker DeGiro.

This means only a part of our funds are invested. Namely 12 872.67€ with the rest 9 498.47€ either in transit or in cash.

This means a total of 22 371.14€ – for August in our ETF Portfolio baseline. Yay. I will be posting here the progress.

The main objective will be to follow the Passive investments of our friends Bogleheads with an european adaptation (Thanks PRIIPS!).

The ETF Portfolio baseline should look like this soon:

| Description | % Allocation | Ticker |

| Long bond | 5.00% | CBU7 |

| Short bond | 15.00% | TIPS |

| Commodity | 5.00% | COMF |

| Gold | 10.00% | AUCO |

| SP500 | 7.50% | CSPX |

| Small-Cap | 15.00% | IMAE |

| Europe | 10.00% | SXRG |

| REIT | 10.00% | EPRU |

| Pacific | 10.00% | CPXJ |

| Emerging | 12.50% | IEMA |

Most of the ETFs are located in the Amesterdam Euronext market in order to lower costs. Unfortunetly Small-caps US had to be bought in the German (XETRA) due to unavailability on the MSCI Ishares Small-caps there.

I will be defining why we chose this strategy and why each particular allocation and also what could be the comparable ETFs but i will leave this for anothe time!

The positions have been opened on the 19th August and currently we are 83.25 € up. Im not worried. We are in this for the long run and this was expected this the markets are in all time highs.

A great website you could use to check our some European ETFs is JustETF, luckily is one of the few that lets you check those ETFs in many of the European stock exchanges.